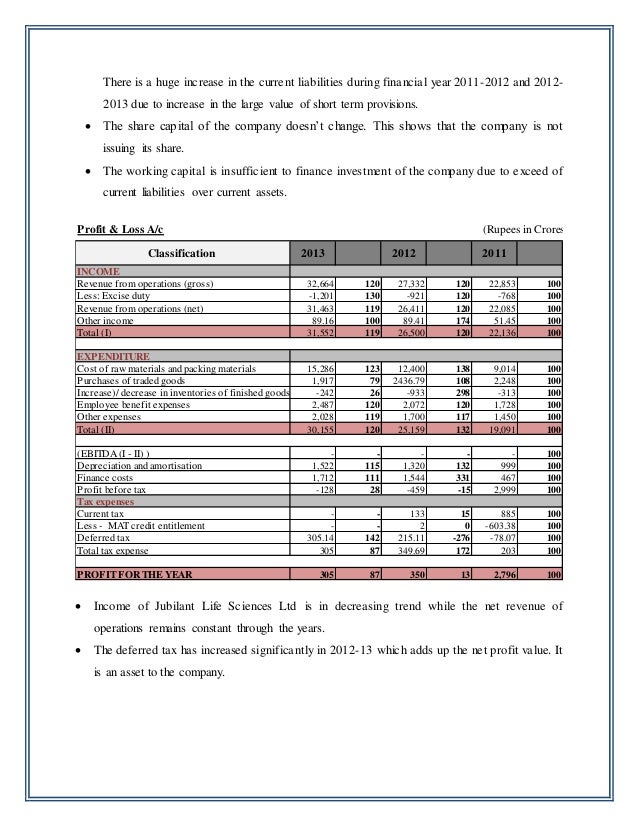

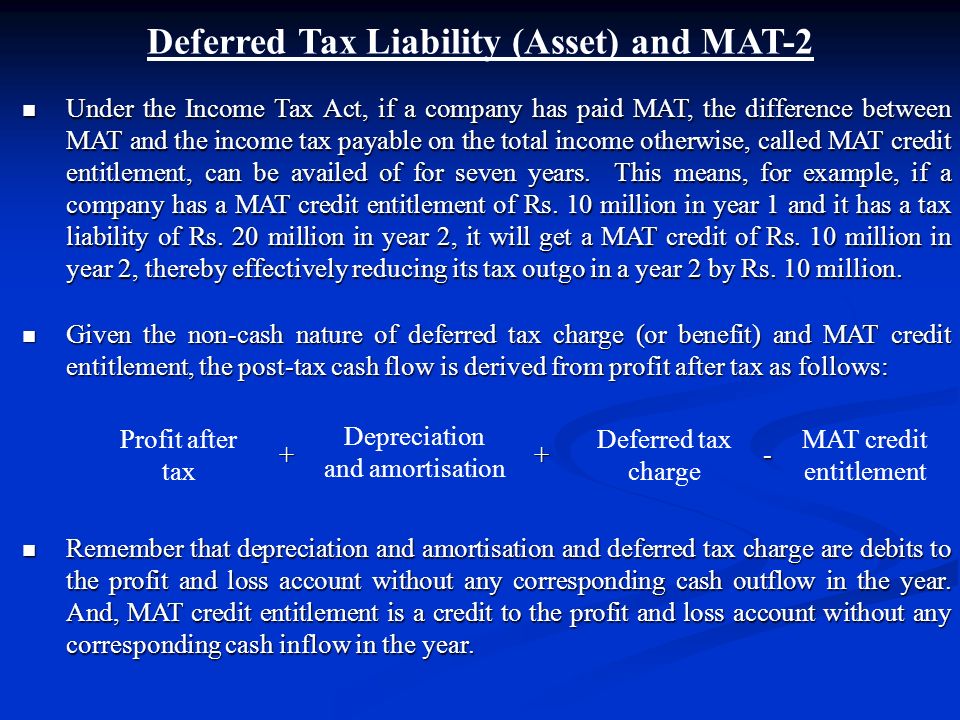

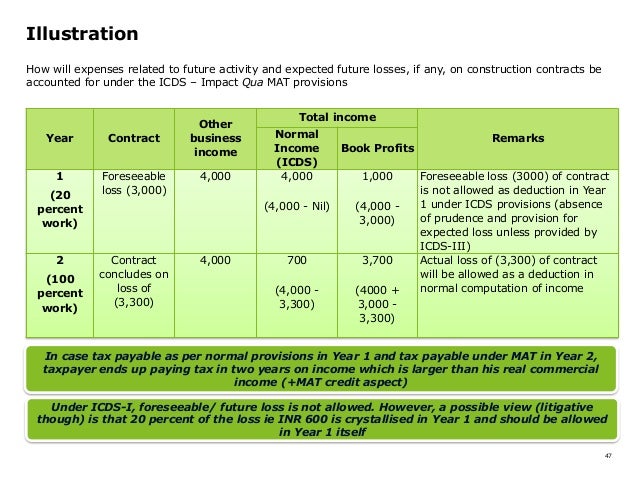

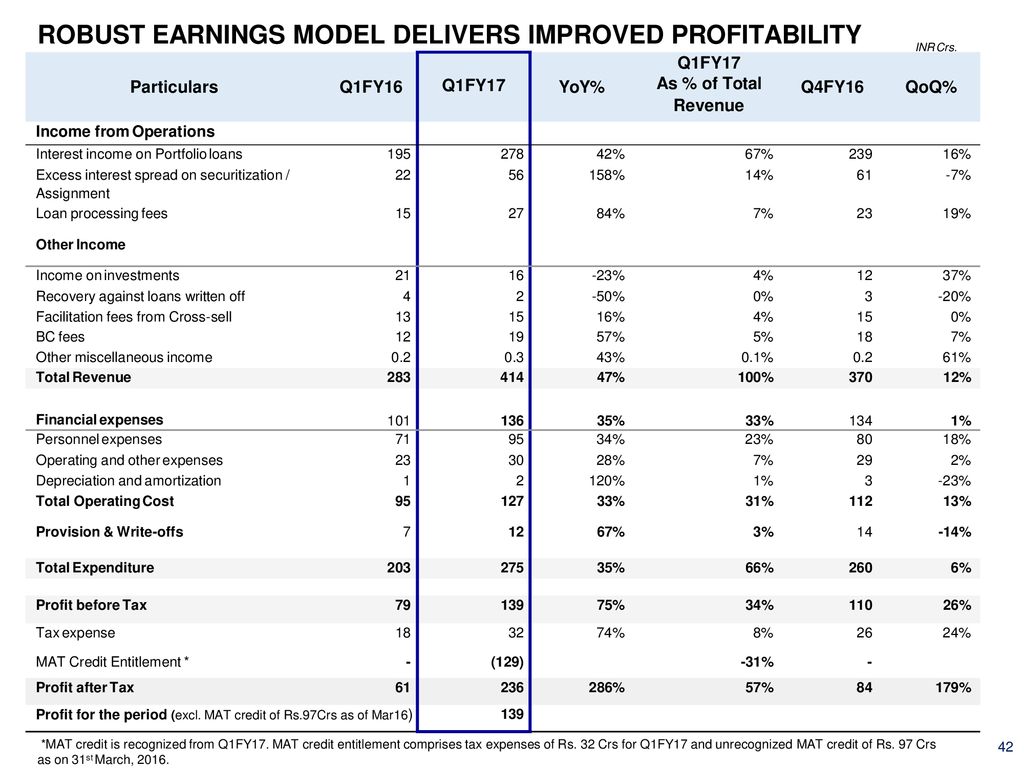

It must also be noted that deferred tax charge is not covered by any other clause of the explanation to section 115jb 2 and is therefore not required to be added back in the computation of book profits for the purpose of section 115jb.

Mat credit entitlement example.

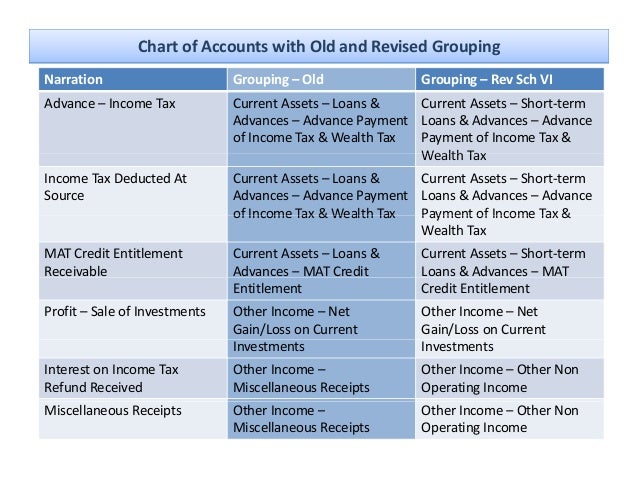

It will be disclosed under loans and advances.

While writing down the mat credit entitlement following entry is to be passed.

Moreover the mat credit set off can only be to the extent of the difference between the regular corporate tax and mat liability calculated.

8 lakh while the liability as per the provisions of mat is rs.

Accounting for this credit would be made if the company is expecting to utilize this credit before it lapses in the future.

To mat credit entitlement a c further mat credit is to be reviewed at each balance sheet date.

This mat credit can be carried forward and set off for 10 consecutive assessment years succeeding the year in which the tax credit first accrued.

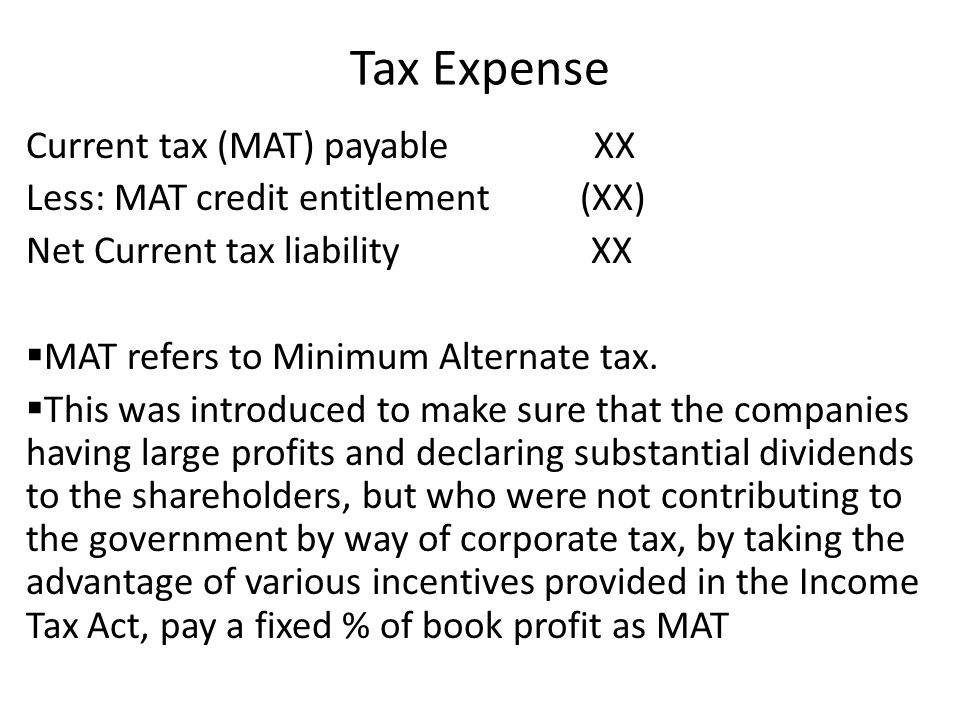

According to paragraph 6 of accounting standards interpretation asi 6 accounting for taxes on income in the context of section 115jb of the income tax act 1961 issued by the institute of chartered accountants of india mat is the current tax.

Such tax credit shall be carried forward for 15 assessment years immediately succeeding the assessment year in which such credit has become allowable.

100 tax as per mat rs 80 tax as per normal provisions i e.

This is with effect from ay 2018 19 prior to which mat could be carried forward only for a period of 10 ays.

Since the company is liable to pay mat the company can avail the difference of the tax payable as per mat and tax payable as per normal provisions as mat credit.

The following entry is to passed mat credit entitlement a c dr.

The cag has reviewed 182 cases in 19 states and found that in some cases there was none or minimal set off that could be claimed but the a o.

To profit loss a c cr.

Ans when the amount of minimum alternate tax mat for a company is greater than its normal tax liability the difference between mat and normal tax liability is called mat credit.

While availing the mat credit.

For more information on mat credit refer to this article.

Profit loss a c dr.

Profit loss account.

The unavailed amount of mat credit entitlement if any should continue to be presented under the head loans advances.

Allowed a huge amount and in some cases where set off could be claimed but the a o.

Rs 14 43 000 rs 12 48 000 rs 1 95 000.

Mat credit is rs 20.

A tax credit scheme is introduced by which mat paid can be carried forward for set off against regular tax payable during the subsequent fifteen years period subject to certain conditions as under when a company pays tax under mat the tax credit earned by it shall be an amount which is the difference between the amount payable under mat and the normal tax.

In the above case mat credit rs.

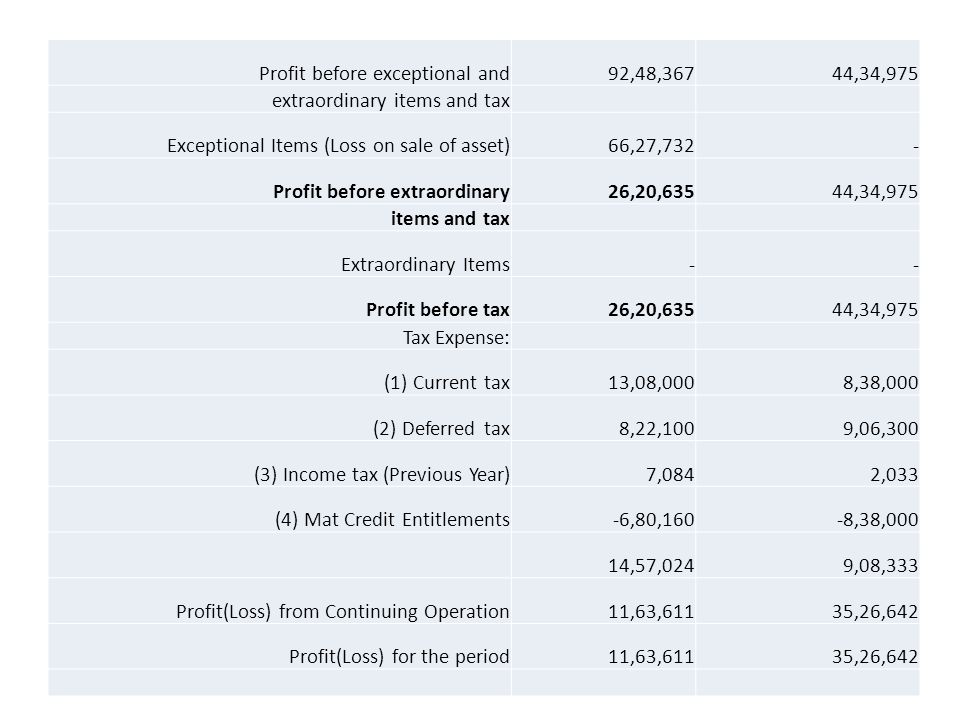

The difference arising out of mat paid and mat credit entitlement can be treated as tax paid during the year.

Provision for taxation a c dr.

Mat credit entitlement will be treated as an asset and the accounting will be done by crediting the profit loss a c if there is a virtual certainty that the company will be able to recover the mat credit entitlement in future limited period.