7b 3 sefs were created by the addition of section 5h of the act by section 733 of the dodd frank wall street reform and consumer protection act dodd frank act for the trading and processing of swaps.

Mat products cftc.

Designated contract markets dcms may list for trading new contracts by filing a self certification with the commission that the new contract complies with the commodity exchange act cea and the commission s regulations or by requesting commission approval.

Organizations with respect to offering products to u s.

The commodity futures trading commission cftc is expected to pass all made available to trade mat filings for new swap execution facilities sefs but uncertainty around leadership could affect the initial period of mandatory trading on the new platforms.

What is traditionsef s status with the cftc.

Low latency and a proven ability to attract deep high quality liquidity in a wide range of interest rate products for both mat and non mat transactions.

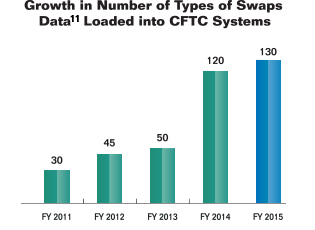

A new initiative to accelerate cftc engagement with responsible fintech innovation and make the cftc more accessible to innovators.

To meet its statutory mission of ensuring market integrity and customer protection with respect to products listed under self.

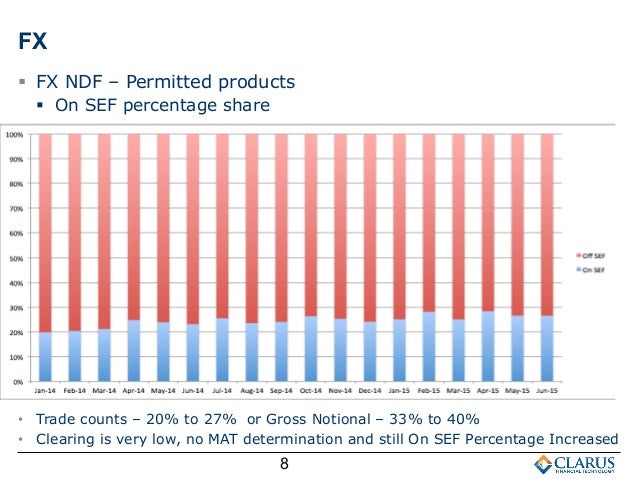

Amir led off the second panel with a presentation showing some of our data reinforcing the various degrees of performance we ve seen in mat d products.

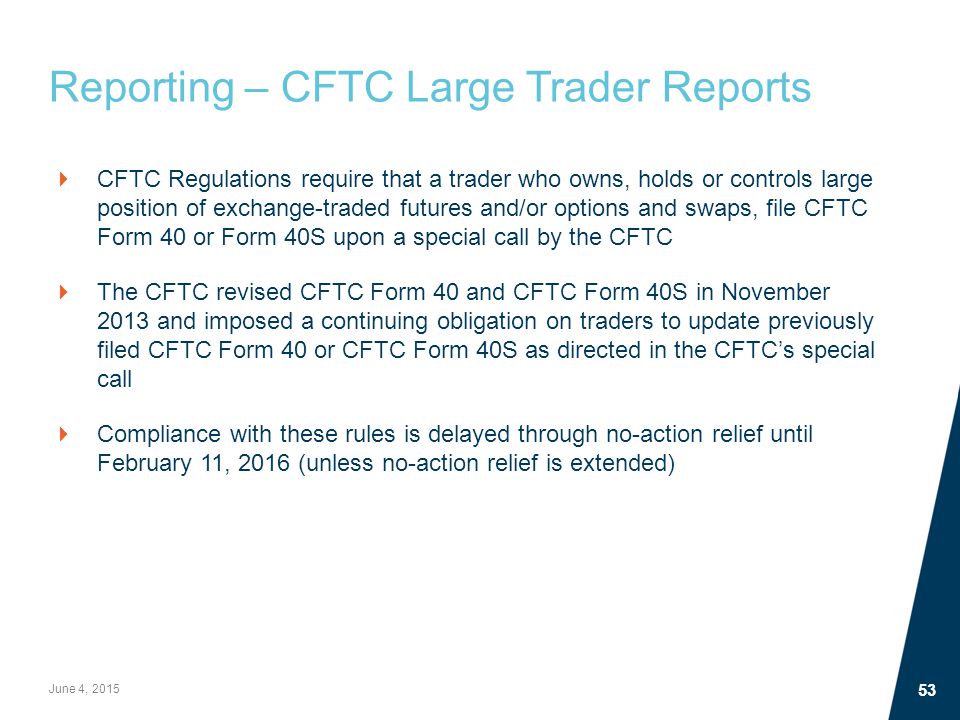

Organization filing description products affected official receipt date status date remarks associated documents.

These trades would have to meet the following criteria in order to be considered mat.

Swap execution facilities sefs are trading facilities that operate under the regulatory oversight of the cftc pursuant to section 5h of the commodity exchange act the act 7 u s c.

1 standard coupon refers to the then current fixed coupon rates for market agreed coupon mac contracts.

Cftc chief economist sayee srinivasan chaired this panel which included amir professors darrell duffie and john hull and kevin mcpartland.

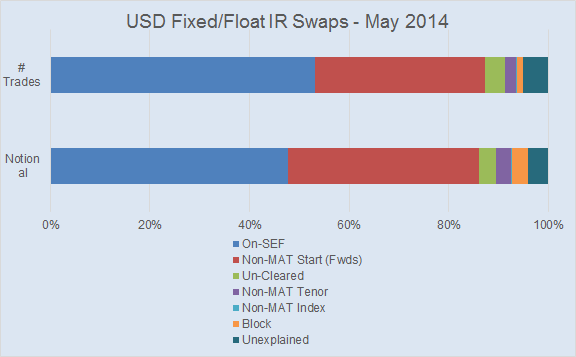

We focus however on the first set of mat certifications for us dollar based trades.

Made available to trade determinations for certain interest rate and credit default swap contracts.

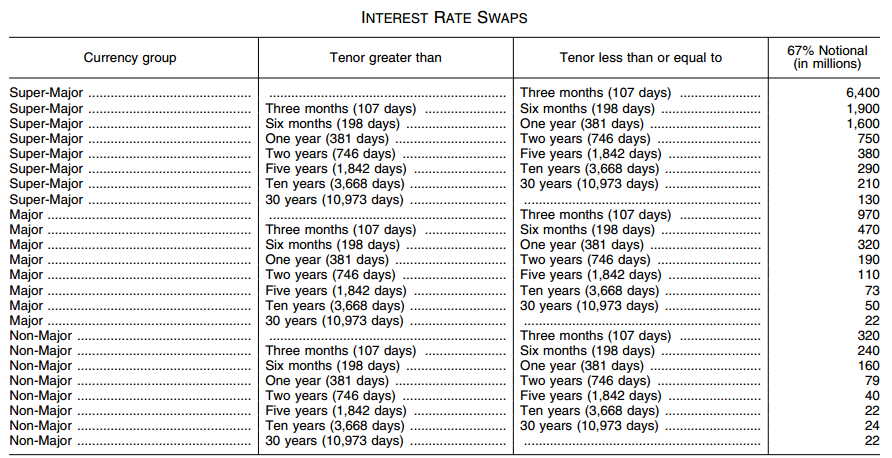

Please refer to the mat submissions located on the commission s website that provide the full list of the swaps made available to trade including the swap terms.

Commitments of traders a breakdown of each tuesday s open interest for markets.

Last week the cftc certified certain interest rate and credit default swaps in usd eur and gbp currencies to be mat.

%2C445%2C291%2C400%2C400%2Carial%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_.jpg)